HOVER is helping property insurance carriers transform the customer experience, break down organizational silos, and streamline the way they work. Along with these benefits come tremendous cost savings. Today we’re taking a closer look at the numbers: how much can carriers save with HOVER? Here’s a line-by-line breakdown.

$300-$500+ SAVINGS: EACH TIME YOU ADJUST A NEW CLAIM

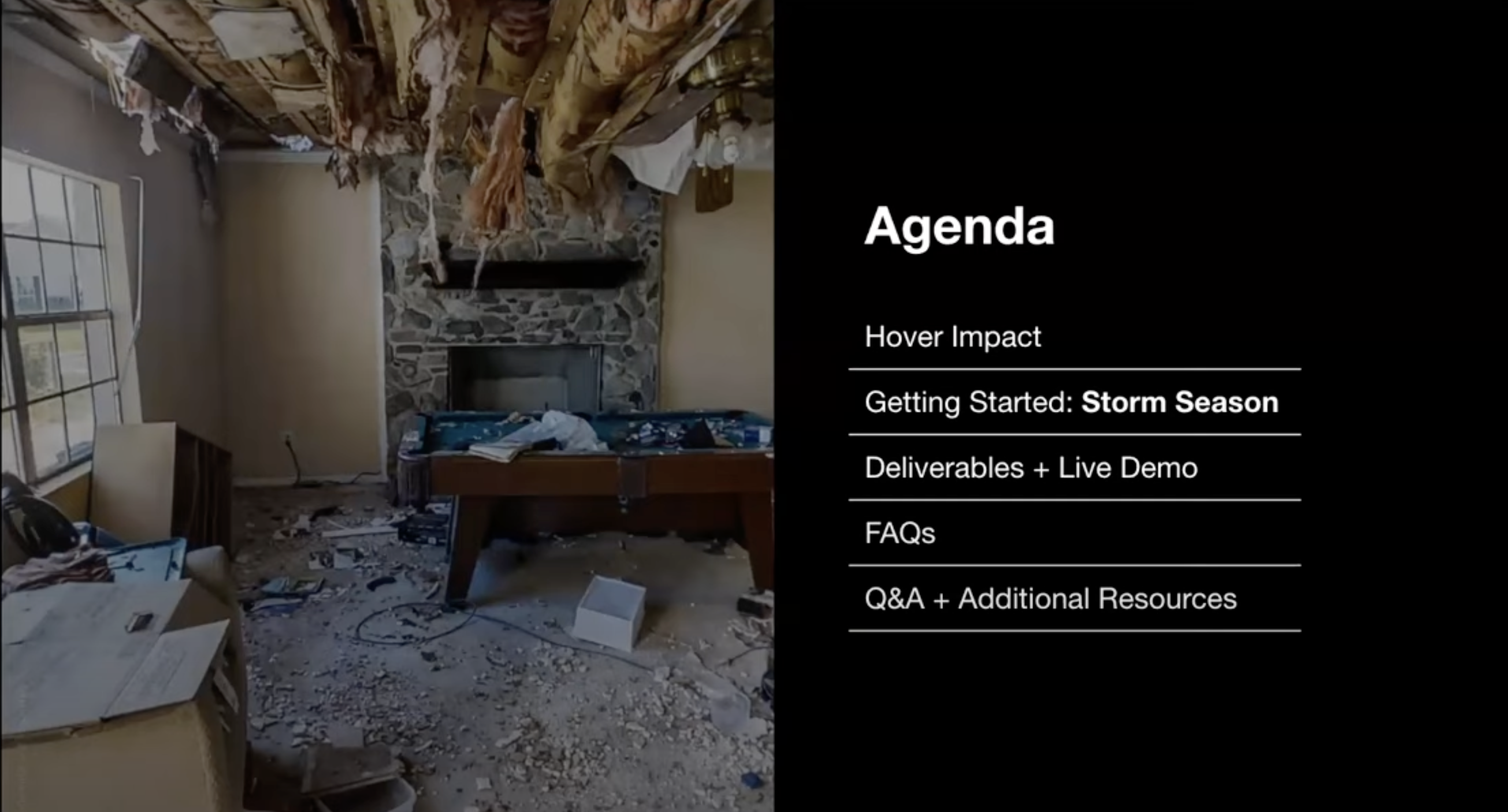

HOVER makes the process of adjusting a claim simple and cost-effective. When disaster strikes, there’s no need to send an adjuster into the field to evaluate property damage. Homeowners can use the HOVER app on their smartphone to take photos of their property, which HOVER then uses to provide adjusters with highly accurate and detailed measurements. With HOVER’s precise property calculations, adjusters have exactly what they need to process claims almost instantly.

Even if you do use a field adjuster, they can supplement their observations with HOVER’s highly-detailed measurements, saving a significant amount of time. You can also avoid potential safety hazards, since a field adjuster would never have to climb up on a roof they consider unsafe. Instead, they could use the HOVER app to capture accurate roof measurements without ever stepping foot on a ladder.

These factors alone could save you anywhere from $300-$500 per claim—not to mention possible workers’ compensation costs, which could add up to significant sums were a field adjuster to have an accident on the job.

$500+ SAVINGS: EACH TIME YOU KEEP A CUSTOMER HAPPY

Attracting new customers is a big investment, so you can’t afford to lose them due to a bad customer service experience. Consider this: if it costs you $500 to attract a customer and they leave you, that’s $500 up in flames. But that’s not all: that disgruntled ex-customer is likely to tell their neighbors about their bad experience, which means your losses could domino. This doesn’t even include the loss that comes from losing the policy to a competitor.

The way that you handle a claim is one of your biggest opportunities to either reinforce customer loyalty or lose their business altogether. In fact, 87% of customers say that the claims experience influences how likely they are to stay with you. Fortunately, this is an area where HOVER can help. Because we provide the detailed information you need to process customer claims faster and accurately, you can transform what may have been a weak spot into a competitive strength. That’s a win-win for everyone.

$30-$150 SAVINGS: EACH TIME YOU OPT FOR A VIRTUAL INSPECTION

The same HOVER technology that helps you process claims faster also helps you underwrite new policies. With the help of a smartphone camera, homeowners can now save you a few steps (and extra costs) associated with home inspections. You no longer need to send an inspector to walk around the property with a tape measure and calculate the home’s footprint. Instead, you can engage homeowners in the process and let them use HOVER to capture all the information you need.

All the homeowner has to do is take eight exterior photos of their home, and HOVER takes care of the rest, generating an accurate, fully-measured 3D model of the property. HOVER can also capture interior photos for an even more comprehensive overview of a home. This gives you the details you need to price a policy as well as any additional information you’d like to capture, from safety systems to plumbing and electrical. Plus, HOVER provides a layer of accuracy that’s superior to outdated virtual inspection tactics, like using stale aerial imagery or old MLS data.

Like adjustment costs, on-the-ground inspection costs vary. However, if we assume about $30 per exterior inspection and up to $150 for a full interior inspection, that adds up to significant savings for each new property you insure.

EVEN MORE SAVINGS: EACH TIME YOU AVOID COSTLY MISTAKES OR LAWSUITS

Insurance is a complex business, and there’s a lot of potential for errors to creep in during the underwriting or claims adjusting process. This opens carriers up to costly mistakes and even lawsuits from customers who complain that their claims were delayed or their coverage was misrepresented. HOVER doesn’t eliminate all of these risks, but it does bring a higher level of accuracy and transparency to the way you do business–and that can help.

First, increased transparency may help minimize your exposure to lawsuits and possibly save you hundreds of thousands of dollars in legal fees. This is because when you and your customer have access to the same information–like HOVER’s time- and date-stamped property measurements and images–it reduces the potential for misunderstandings and possibly even fraud.

HOVER also helps close the gap between the underwriting and claims side of your business. Because underwriters can use HOVER to get extremely accurate, real-time property data, they can issue better policies. And if there is ever damage to the property, claims representatives can be confident that the policy was priced correctly instead of being sidelined by unforeseen losses. HOVER makes it possible for underwriters and claims adjusters to work together like never before, using the exact same data to make better business decisions.

HOW IT ALL ADDS UP

How much money can HOVER save your business? Multiply these dollar estimates by the number of in-person adjustments or physical home inspections you order each year, and you’ll start to realize the enormous savings potential that HOVER brings to everything from underwriting to claims processing. And after you factor in the potential for greater customer retention and fewer lawsuits and costly mistakes, the benefits start to get even bigger. Interested in giving HOVER a try? Get started here.