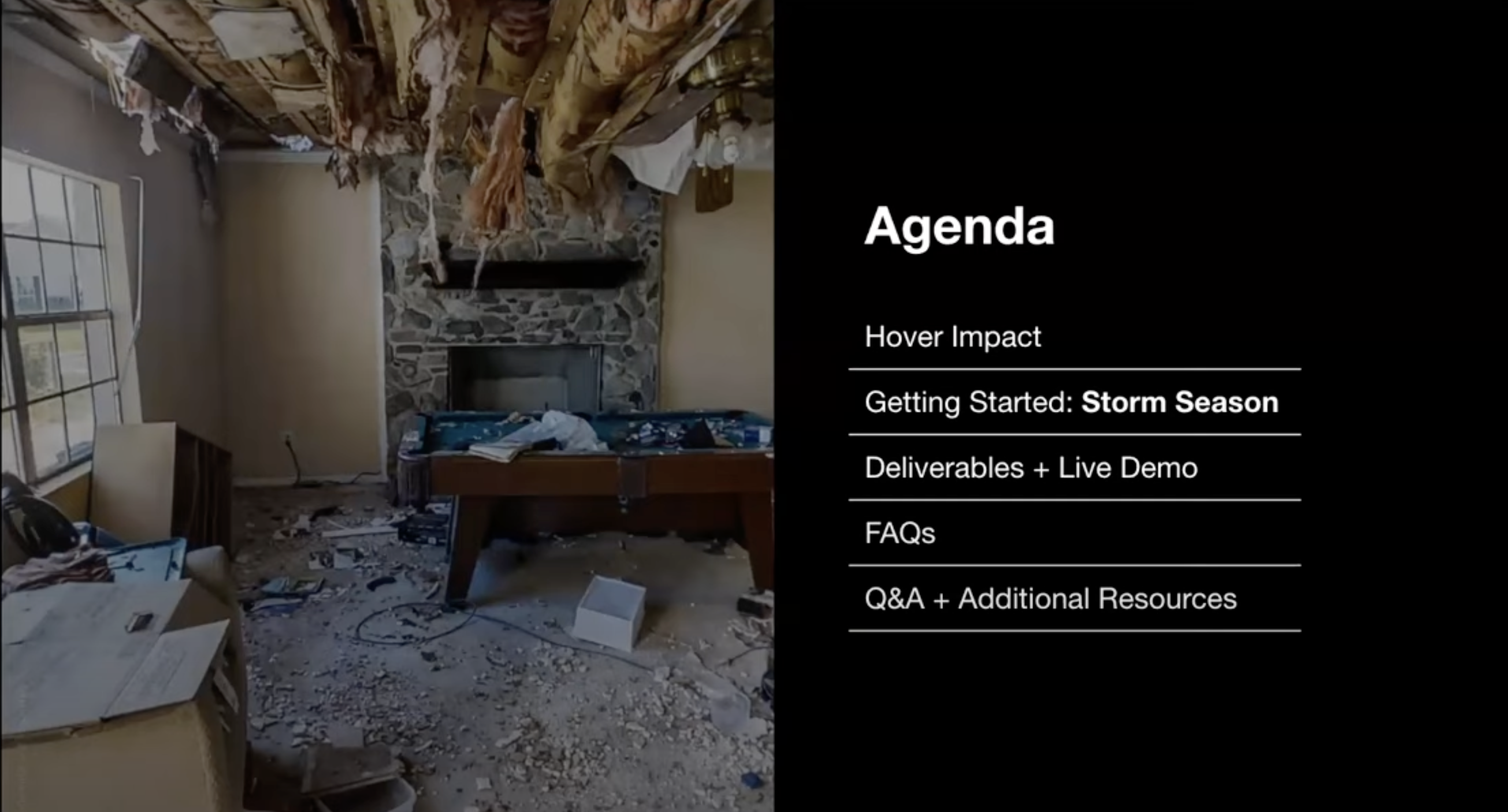

When Mother Nature hits, homeowners and their properties face brutal consequences—the aftermath of a storm can leave a trail of destruction, including roof damage, broken windows, and structural issues

It's then up to the insurance adjusters to assess and process storm damage claims. The traditional operation for documentation is time-consuming and can take a while, adding another burden to stressed homeowners. Here we’ll get into how HOVER is the ideal solution for adjusters and how it’ll streamline your workflow.

How HOVER Revolutionizes Adjuster Workflows

The Challenges of Traditional Methods

Historically, insurance adjusters have relied on manual processes to evaluate storm damage. This means going to the damaged home, taking pictures, getting back to the office, and drawing up the proper documentation and recommendations for the insurance company. If it is an especially large storm, there can be many homes in one area that are severely damaged, meaning you have to visit numerous locations.

Another challenge of the traditional process is the potential for human error and inconsistencies. People aren’t perfect, so there are bound to be inaccurate measurements, misinterpretation of damage severity, and discrepancies in reporting. Such errors can result in claim disputes and extended processing times—adding to a homeowner’s stress and frustration during an already difficult time.

How HOVER Can Help Insurance Adjusters Streamline Their Processes

HOVER provides adjusters with a streamlined and highly accurate solution for assessing storm damage. Using a combination of advanced computer vision, machine learning, and 3D modeling, HOVER enables adjusters to remotely and accurately assess the extent of damage to a property. Here are just a few key benefits:

Virtual Assessments

With remote damage surveys and the ability to invite policyholders to photograph their homes, adjusters can significantly reduce the time and resources needed for the assessment process. This means more claims are handled in a shorter amount of time.

Accurate Measurements

Minimize errors and settle property claims quickly and more accurately. From the photographs, HOVER's 3D modeling technology can then provide accurate measurements of key, damaged areas. Plus, better measurements mean more accurate estimations.

Comprehensive Documentation

You can easily import the 3D model data and accurate measurements directly into your claims management tool of choice—goodbye to manual sketching. These comprehensive visuals provide a clear picture of the damage to both the adjusters and homeowners, facilitating transparent communication throughout the insurance claims process.

Faster Claims Processing

By expediting the assessment process, insurance companies can get the claims processed faster. While it usually takes up to 10 business days to reach the final settlement, with HOVER it only takes a few hours. Reduce the wait time for homeowners and make it possible to manage a larger workload—a real win-win.

Improved Customer Experience

Detailed estimates with damage documentation help homeowners and contractors trust the resolution. Homeowners can better understand the damage and the scope of necessary repairs, leading to more productive conversations with contractors, and increased satisfaction with their insurance providers.

Discover a More Efficient Insurance Claims Process with HOVER

HOVER enables adjusters to conduct virtual assessments, obtain accurate measurements, and create detailed visual documentation. This innovative approach to home restoration and claims for storm damage shows how technology streamlines processes and improves customer experiences. See how we can make it more efficient for homeowners to file a claim and get it approved—so they can get back to normal, faster.