The P&C Insurance industry is under significant pressure from dramatically increasing losses. Industry response to these losses, including higher rates and statewide pull-outs, is weighing heavily on customer satisfaction, with homeowners preferring price over loyalty (JD Power).

Understanding these realities, many carriers must find ways to improve profitability, business predictability, and operating efficiency. Hover is committed to working with critical partners like Verisk to meet these challenges head-on.

Existing Realities

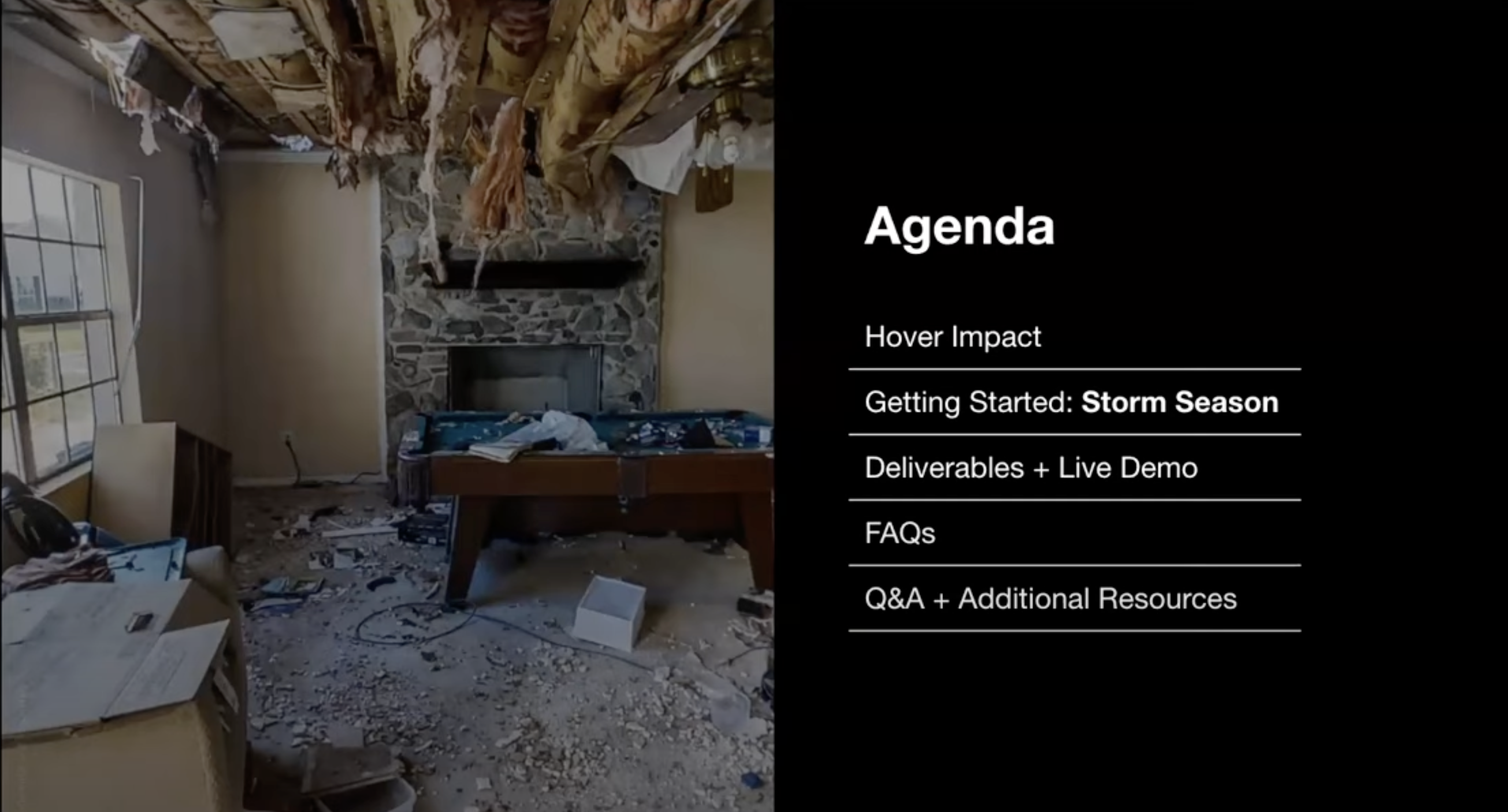

Between more catastrophic weather, rising costs from inflation, and declining customer satisfaction, the P&C industry is facing one of the toughest operating environments in years.

- Losses from Catastrophes Continue to Grow

According to NOAA, 2023, the U.S. saw 28 weather/climate disasters with losses over $1 billion each, with losses from severe convective storms in particular reaching a record US$50 billion in 2023 (Swiss Re Institute). And the upwards trend is expected to continue. According to Verisk’s 2023 Global Modeled Catastrophe Losses Report, “Over the past 5 years, actual insured losses from natural catastrophes have averaged $101 billion (USD) compared to an average of less than $70 billion over the previous 5-year period.”

Loss-producing events are evolving beyond hurricanes to include more frequent thunderstorms and severe convective storms – most of these occurring in geographic regions that have seen an influx of new residents along with high-value properties. In 2023 alone, U.S. thunderstorms accounted for 21% of the Global Average Annual Loss (AAL).

- Material and Labor Costs Remain High

While net investment income has helped offset some underwriting losses, the P&C Industry is also not immune from inflation. Since COVID, insurers have been seen restoration costs rise nearly 34% and increased trade costs of 27% - in part due to supply chain disruptions and inflation (APCIA).

- Profitability and Customer Satisfaction Are At Risk

To keep up with the rising costs, insurers have been forced to increase premiums. On average, homeowners have seen double-digit rate hikes every month since February 2023. While these premium increases have grown top-line revenue, they haven’t fully covered rising costs.

All of this is occurring at a time when maintaining high customer satisfaction is as critical (and as difficult) as ever. Nearly 60% of homeowners who switched carriers attribute the switch in carriers to price (JD Power). A study by Accenture found that, “a third of claimants were not fully satisfied with their recent claim experience” – leading to the risk of $170 billion in renewal premium transfer across the industry over the next five years.

“The combined effects are resulting in the hardest market cycle in a generation,” said Karen Collins, APCIA vice president, property and environmental.

Policyholder Involvement Can Drive Change

At Hover, we believe improving how the insured engage throughout their policyholder journey is key to resolving many of the challenges facing the industry today. By involving policyholders and leveraging technology like Hover and Verisk, the insurance industry can deliver a simpler, faster customer experience while reducing costs. How?

When insurers engage their policyholders by using innovative technology like Hover, they unlock key benefits:

- Cost Reductions and Other Efficiencies

Engaging policyholders in the data collection process at First Notice of LOSS (FNOL) can lead to better triaging of a claim before costly resources are deployed. When a carrier or adjusting firm has access to Hover information early on, more cost-effective decisions can be made about the right resources to deploy.

For example, some claims can be settled directly from the desk without the need for an onsite adjuster. Other claims may only need a quick verification of a material component or measurement from an inspection team. Recognizing early on when lower-cost resources can be deployed can lead to significant cost and time savings.

- Accelerated Approvals and Claims Settlement

Each time a policyholder is invited to complete a Hover job as part of the claims process, they can potentially eliminate an unnecessary onsite visit – and speed up their claim. The reason for this is that each Hover job includes a critical package of information that is robust enough to settle many claims directly from the desk. This package includes measurements, quantities, floor plans, an exterior 3D model, damage photos, and close-up imagery of inside and outside of the property.

An Easy Solution for Homeowners

Over 500K insured homeowners have shown a willingness to use Hover to complete a capture during the claim process, and the number continues to grow. We believe homeowners engage with Hover because they understand it can speed up their recovery. This is supported by a J.D. Powers study that found that customers who engaged directly with a digital solution in the claims process started repairs 9 days sooner than those who did not.

More than Measurements

Hover offers much more than a simple measurement solution for on-site inspections. We provide value across the entire insurance lifecycle. From new policy underwriting through claims, Hover has become a trusted source of truth throughout the policy and claim lifecycle, partnering with the majority of top carriers and all adjusting firms in the U.S.

Hover recently launched a series of updates for our customers who use Verisk solutions:

- Interior Solution Launch

With our Interior Solution, Hover is the first company in the market to deliver a single end-to-end solution that can be used by policyholders to speed up the claims process for any claim involving damage to interiors and exterior roofs and elevations.

Hover’s interior product makes it easy for policyholders to submit a broad range of interior damage claims, including cases where a structure is missing or damaged. Ease-of-use features include quick checklists to support preparing the environment for capture, auto-capture technology that eliminates the need to manually take each photo, and room-by-room technology that guides the user as they navigate their home.

- A Seamless Policyholder Invite From Verisk Xactimate

The Hover solution suite (including roof, elevations, and interiors) is now fully integrated with Verisk Xactimate. Now, carriers and adjusting firms who use Verisk can deploy Hover to their policyholders for ANY interior and exterior claims at First Notice of Loss (FNOL) and receive back a comprehensive set of measurements, plans, and damage photos directly into Xactimate.

- Smoother Importing Into Verisk

We’ve upgraded our ESX file to match Verisk’s best practices, delivering seamless compatibility with Verisk features and functionality and the ability to import everything from the Hover job beyond the 3D sketch (including damage photos, plans, and PDFs). Organizations can also customize which elements of a Hover job to include in the file.

What’s Ahead

Hover will continue to enhance and streamline the entire insurance lifecycle. We are dedicated to making the inspection process as effortless and rapid as possible for policyholders – not only during the claims process but while purchasing new policies as well.

Hover is dedicated to transforming the insurance industry by placing policyholders at the center of the claims process. With a strong emphasis on digital solutions, seamless integration, and a commitment to enhancing policyholder experiences, Hover is leading the way in delivering exceptional policyholder-focused insurance solutions.