The property insurance industry is as competitive as it’s ever been in this country, thanks in large part to the wide range of options homeowners have when it comes to selecting an insurance carrier. It’s always great for consumers to have a wealth of options to choose from, but what it means for carriers is that their customer service processes have to be airtight.

A bad claims experience is the number one reason a homeowner will switch carriers. And there are bigger stakes than meets the eye should this happen: if a carrier loses one customer from a bad experience, they likely lose four of that customer’s neighbors, too. Let’s assume that customer acquisition costs are $500 for a new homeowner policy. This means that a carrier can stand to lose $2,500 every time a negative customer experience occurs (took too long, the customer feels like they were left on their own, etc.).

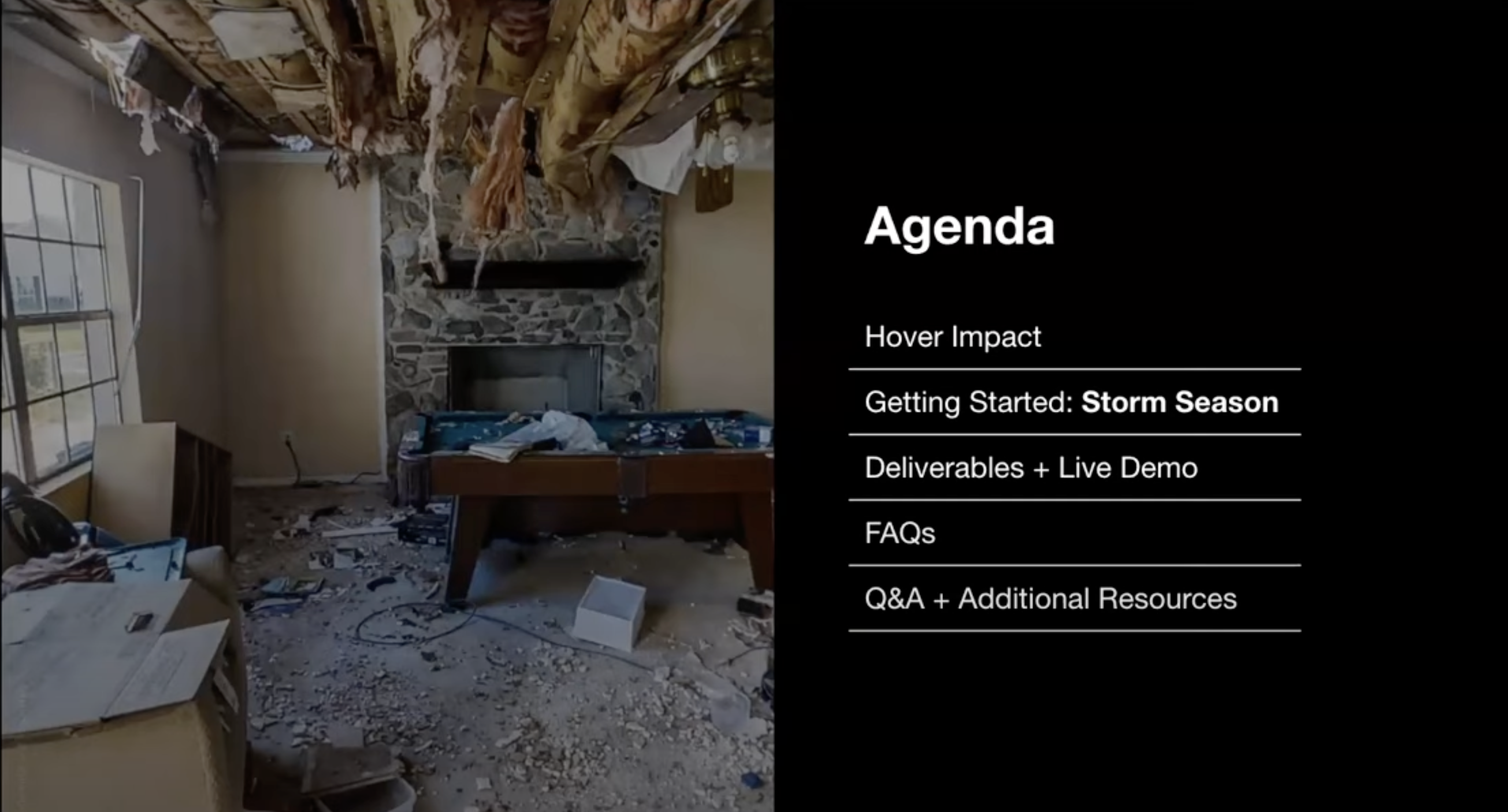

If we think about the current state of affairs for property claims processing, there are quite a few moving pieces that could lead to an unsatisfied customer. A homeowner has to set an appointment with an adjuster. They have to take time off work to accommodate that appointment. The adjuster scopes the damage, reviews coverage, takes measurements, and then writes the estimate. It could be days––or even weeks––before the homeowner gets a check indemnifying them for their loss.

The process is inefficient for carriers, too. There are somewhere in the neighborhood of five million exterior damage claims each year in the U.S., and the property casualty industry pays out approximately $30 billion a year on those claims. On average, it costs carriers about $500 to send an adjuster out into the field to process a claim. That’s an additional $2.5 billion expense that carriers are bearing today. Given loss ratios over the last decade, that is a huge cost that is hurting the bottom line and causing homeowners to pay more for insurance.

In a world where the phrase “every company is a technology company” has become commonplace, the insurance industry has a lot of catching up to do. Indeed, insurance is one of the last massive industries which will be disrupted by technology. There are technological advancements here and there––for example, using AI and chatbots to help drive policies, keeping a home safer with connected home systems like NEST or Ring, and utilizing solutions that hook up to your water system to detect leaks––but these are far from the industry-wide disruption we’ve seen technologically in other sectors. While people are continuing to whittle away at pie-in-the-sky technological innovations that someday might move the needle, we propose a simpler solution that will go a long way: utilizing the technology everyone has in their pocket to streamline claims processing and leave carriers and homeowners happier as a result.

Smartphones and the sensors within are as powerful and accurate as they’ve ever been.

Think about it: where is the biggest logjam in the claims process? It’s in the adjuster visit to the property, and the ensuing measurements and estimate upon which the claim is paid. Half the cost of processing a claim goes to travel alone, and after that, the measurement process is subject to inaccuracies and potential mistakes. Most would agree this is a process that is in need of an upgrade.

Enter HOVER. Our platform allows homeowners to take photos of the damage to their home and share them directly with adjusters. We also have thousands of professional field adjusters, independent adjusters and roof inspection companies using the platform to save time. We use our patented technology to turn the photos into a scaled 3D model of the home and generate accurate measurements of all key elements on a home’s exterior, including roofing and siding. We also give the homeowner the 3D model to easily design improvements to their home, now and in the future.

Through HOVER, we capture the correct measurements the first time and, in many cases, eliminate the need for the adjuster to travel to the site altogether. Homeowners can control the process themselves, and adjusters can work more efficiently, knocking out 5-6 claims a day instead of 1-3. A process that once cost $500 now costs $50, and takes hours instead of days, streamlining and expanding business for carriers and eliminating the headache that many homeowners associate with the often messy property claims process.

This isn’t to say we shouldn’t be exploring every possible technological avenue to bring the insurance industry forward into the 21st century. What we’ll find in the long run is that so many technologies have the potential to complement one another; we don’t need to put all our eggs in one basket. But in a time where customer service can be a paramount competitive advantage, it’s worthwhile for carriers to investigate ways they can tailor their processes to the customer. One of the best ways to do this is by involving homeowners more actively in the process. They want their claims processed as quickly as possible, so why not give them a “help me help you” option?

We don’t need to completely uproot existing workflows to see technology improvements in the insurance world. The processes may not necessarily be broken so much as in need of a touch-up, a boost of modernization. We at HOVER believe we will be an important part of this transformation, and we hope to inspire others to consider the ways they can start helping their customers and improve their business practices, not in five or ten years, but today.