The rise of COVID-19 and everyone’s preference to do things online means the process of property insurance claims has gone virtual—which is great news for insurers and policyholders.

With virtual claims processing, customers are happier and insurers can see a 50% reduction in the cost of processing claims, making it easier to reduce costs and result in even happier customers.

Here, we’ll dive into what the virtual claims process is and how you can streamline it using HOVER.

Understanding the Virtual Claims Insurance Process

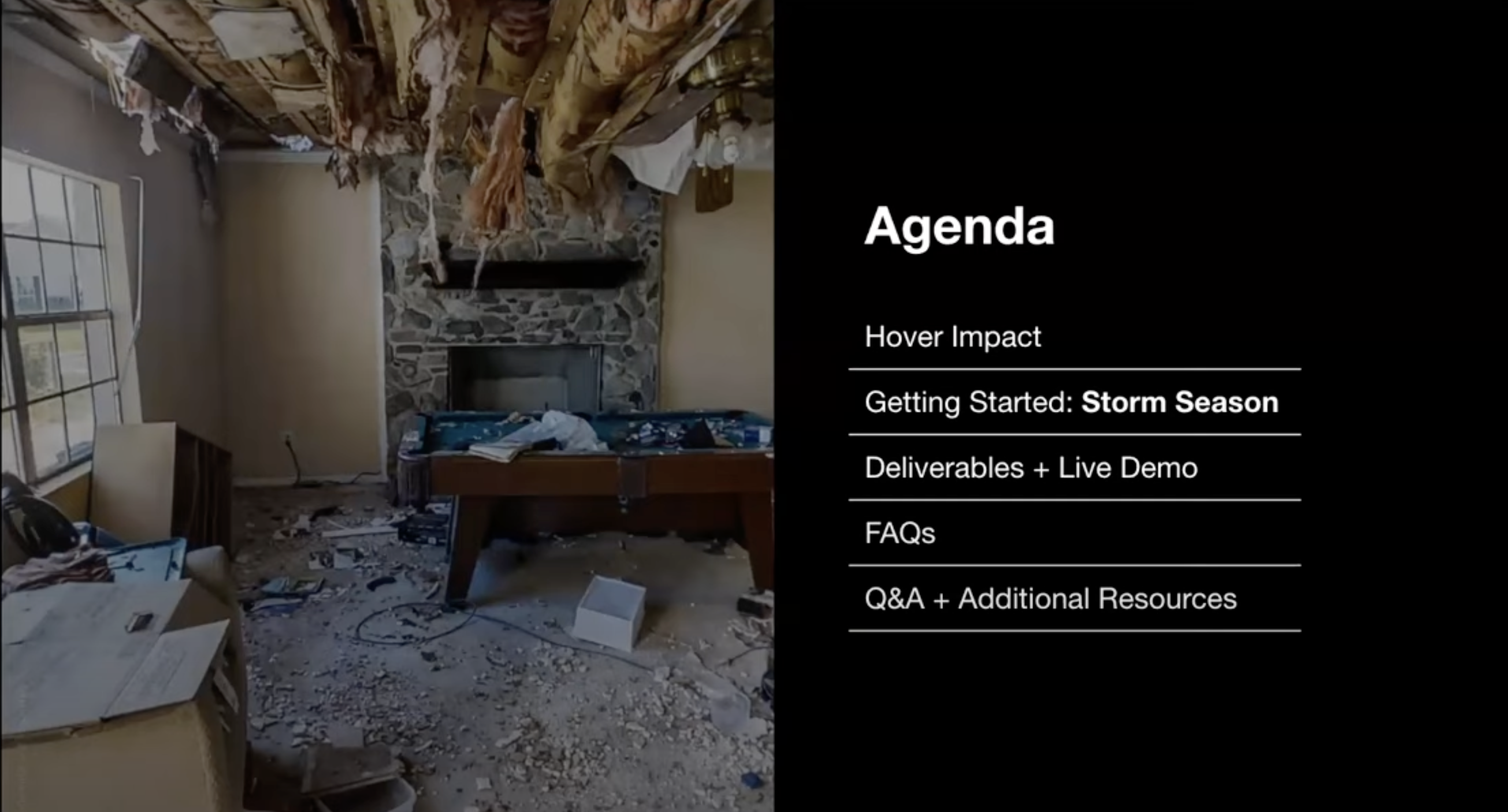

The virtual claims insurance process is a new and modern way for insurers to assess damage. It’s easy: a customer or vendor takes photos or video of the property damage and then uploads those images to their insurer, where an adjuster conducts the assessment remotely.

An insurance employee is no longer needed on-site to conduct a physical inspection of the property. This new way of processing claims has reduced the timeline from 15 days to one or two days. It’s no wonder over a third of every insurance carriers use a virtual claims insurance process.

How HOVER Can Streamline the Process

Our technology makes it easy to assess damage when disaster strikes. Homeowners can use the HOVER app on their smartphone to take photos of their property.

HOVER then uses those pictures to provide adjusters with highly accurate and detailed measurements. With the app’s precise property calculations, adjusters have exactly what they need to process claims quickly.

Even if you do use a field adjuster, they can supplement their observations with HOVER’s highly detailed measurements, saving a significant amount of time.

You can also avoid potential safety hazards because your field adjuster would never have to climb up on a roof they consider unsafe. Instead, they could use the HOVER app to capture accurate roof measurements without ever stepping foot on a ladder.

More than just time, these factors alone could save you anywhere from $300-$500 per claim.

First Notice of Loss (FNOL) to Claim Settled Faster!

Using the HOVER app it takes only seven hours to get from FNOL to settlement, not 15 days. Through the app, you send a text to the homeowner encouraging them to download the app and take pictures through their phone within the hour.

With those uploaded photos, a 3D model with accurate measurements is created, and those better measurements create better settlements. The adjuster can then pass the property measurements right into Xactimate, Symbility, or other claims software. So long manual input!

More Satisfied Customers Is Better for Business

Nearly 90% of customers say that the claims experience influences how likely they are to stay with their insurer.

HOVER provides the detailed information you need to process customer claims faster and more accurately. A faster process means policyholders can restore their homes more quickly leading to improved customer satisfaction.

What’s even better, is that once they’ve experienced your virtual policy process with HOVER, they’ll sing your praises to the neighbors about how easy it was to get their damage assessed and fixed. And the word of mouth of a happy customer is priceless.